When considering real estate for investment, one can purchase land or building. Generally the drive has been to buy a built apartment that comes along with a portion of undivided share (UDS) of land associated with it and shared by all the other owners of the building’s space. Though built apartments are viable for own use; however the highest returns on investment are only on vacant land or plot.

While buying land within central areas of the Chennai city is near impossible with valuations in crores, there are variety of opportunities in land investments in suburban areas fringing the city. A large number of layouts and gated communities are situated across the metropolitan region and adjacent to the different highways that radiate out from the city. There are reports from various investors that land prices have gone up exponentially in the last ten years, as much as 10 times over the original prices of sale less than a decade ago. Due to a great scarcity of good land for housing development the value is expected to grow over time.

This being said, when deciding a piece of land that should be purchased or not, one should confirm whether the land is nanjai (wet land) or punjai (dry land). Apart from checking whether the land is legal, approved, approach road, electricity, water availability, etc., this is also an important aspect that should be given due consideration.

Better understanding on Plot Vs Flat can be of good help before making an investment.

| Details | Land / Plot | Flat / Apartment |

|---|---|---|

| Cost | Depends on locality, size and accessibility | Depends on locality, services, accessibility, size, design and developer’s brand |

| Land Area | 100% – Value for Money | UDS (Undivided Share) – 40 to 50% |

| Value Appreciation | Expected decent appreciation in minimum 5 to maximum 15 years subject to investment made in growing area. The value normally appreciates due to zero depreciation on land. | A flat has a limited life span, so its value has a diminishing effect. After a certain period of time, there is stagnancy in the growth. The depreciation on construction reduces the growth rate, therefore its value grows with a diminishing rate. |

| Flexibility | Flexibility to own development or joint development as per future requirement – Residential, Commercial, Industrial, Institution, etc., | Lack of flexibility in use, modification and expansion are hindrance to a quicker growth w.r.t land. |

| Dependency | Zero – Decision is ours can do anything | Dependent on neighbour Flat Owners for any development activities |

| Resale / Disposal | Can suit anybody so reselling is possible at any time | Limited Options and suits only on need basis. General human tendency is always to buy a new Flat so reselling after 5 years would be difficult except few areas in the heart of the city. |

| Suitable for | Investment & Immediate Occupation | Viable only for own use with a necessity to live in city |

The most commonly marketed plots in and around Chennai include Panchayat, DTCP and CMDA approved plots. There are numerous questions on the layouts approved by nodal authorities or town planning authorities.

Generally, agricultural land is divided into two types. The dry land is known as Punjai and the wetland is known as Nanjai. The difference between the two depends on whether they are connected by an irrigation channel or not. According to a previous Supreme Court judgment, wet lands or Nanjai lands are meant to be specifically conserved for agriculture. So approvals are given only to Punjai lands for Residential Layout or Mixed development. Please ensure to confirm the type of land before investing.

The most commonly marketed plots in and around Chennai include Panchayat, DTCP and CMDA approved plots. There are numerous questions on the layouts approved by nodal authorities or town planning authorities.

The commonly marketed layouts which do not have approval are often marketed as Panchayat approved lands. This terminology has been unofficially associated with layouts which are unapproved by town planning authority (e.g. DTCP) or nodal authority (e.g. CMDA). It has been customary to call unapproved plots as Panchayat approved layouts. Brokers and the so called “realty developers” always use the term Panchayat approved for selling unapproved layouts.

It is a known fact that only Town and Country Planning authorities (such as DTCP) along with nodal planning authorities (CMDA) can only approve layout plans. Once these layouts are approved, Panchayat may have the ability to approve building plan subject to certain regulations. This delegation of power to approve building plans is limited to certain regions only. However, Panchayat can never approve a layout plan.

Now if a buyer has purchased the so called “Panchayat approved land” (unapproved plot) the only way out is to sell it out to another buyer willing to buy unapproved plots or to get the approval. In most cases, approval can be obtained if regularization schemes are introduced by the state government. This is true for metro regions where some part of the layout (unapproved) has gained approval. OSR (Open Space Reservation) charges need to be paid before approval can be obtained. However, some layouts may never get approval if it has been marked for infrastructure projects or marked under special categories such as ASI (Archeology Survey of India) restriction.

In Tamil Nadu, the power to approve land development is vested in two authorities – the DTCP (Directorate of Town and Country Planning) and the CMDA (Chennai Metropolitan Development Authority). Here are the essential difference between approvals granted by the DTCP and the CMDA

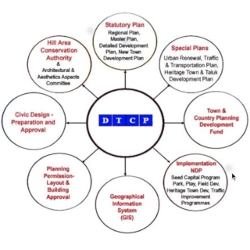

The Directorate of Town and Country Planning (DTCP) has approval jurisdiction over most of Tamil Nadu (except the area covered by the CMDA) including both plan- and non-plan areas (Plan areas are those areas in Tamil Nadu other than CMDA areas, wherein the Department of Town and Country Planning has prepared Master Plan which is duly approved by the Government). It functions under the control of the Housing and & Urban Development Department of the Secretariat.

The layouts approved by DTCP or CMDA carry the benefit of owning a land which can be used for the specific purpose that is designated by the respective planning authority. The approval process involves time and cost which are often the main reasons due to which many developers prefer to sell unapproved layouts.

Chennai Metropolitan Development Authority is a statutory organization of the Tamil Nadu Government constituted in the year 1972 under the Tamil Nadu Town and Country Planning Act 1971. CMDA’s responsibility is among other, to regulate all physical developments within Chennai Metropolitan Area on planned lines. For this purpose CMDA has prepared a Master Plan which designates the land use permissible in every part of the Chennai Metropolitan Area. The CMA covers an area of 1,189 sq.km spread over three districts including the whole of Chennai District, together with some taluks of Tiruvallur & Kanchipuram Districts covering local bodies such as Chennai Corporation, 7 Municipalities, 12 Town Panchayats and 179 villages in 10 Panchayat Unions. The CMDA has approval jurisdiction for the CMA.

| District | Taluk |

|---|---|

| Tiruvallur | Ambattur, Gummidipoondi, Madhavaram, Ponneri, Poonamallee and Tiruvallur |

| Chennai | Tondiarpet, Purasawalkam, Perambur, Ayanavaram, Egmore, Aminjikarai, Mylapore, Velachery, Mambalam, Guindy |

| Kanchipuram | Alandur, Chengalpattu, Kanchipuram, Sholinganallur, Sriperumbudur and Tambaram |

CMDA has classified land into different zones under CMA Limit as listed below. All the “residential plots” approved by CMDA will come under only in the first three zones listed below.

Documents prepared by Individuals, Government, Public or Private bodies which are certified by Government Authorities.

Documents prepared by Individuals, Government, Public or Private bodies which are certified by Government Authorities

| Documents | Requirements |

|---|---|

| Registered Deed / Document | Registration is basically an official record of buying / selling of land by one party (buyer) from another party (seller). This happens at the registration office through any of the documents namely – Sale Deed, General Power of Attorney, Settlement Deed, Partition Deed, Exchange Deed, Mortgage Deed, Gift Deed, Deposit of Title Deeds, Affidavit, Rectification / Ratification Deed, etc., |

| Unregistered Document | An Agreement between two parties accepting to the terms and conditions involved in buying / selling of a property before registration. A Receipt given to seller / buyer acknowledges money transfer. |

| Current / Present property Documents | Registered documents in the name of the Present Owner. It could be a Sale Deed, Settlement Deed, Gift Deed, Power of Attorney, etc. |

| Parent / Mother Documents | Ownership of property changes hands through a series of transactions. It is very important to trace the ownership of a property. Parent / Mother deed acts as the main legal document as evidence of ownership. It also acts as the main document for further sale as it establishes proof of ownership. Parent / Mother deed can be documented as Sale Deed, Settlement Deed, Gift Deed, Power of Attorney, etc |

| Collateral or Mortgage | Property or other assets that a borrower offers a lender to secure a loan. If the borrower stops making the promised loan payments, the lender can seize the collateral to recoup its losses. Because collateral offers some security to the lender in case the borrower fails to pay back the loan, loans that are secured by collateral typically have lower interest rates than unsecured loans. A lender’s claim to a borrower’s collateral is called a lien. |

| Approved Layout Map / Sketch | Layout Certified by Government for Residential Use – An Individual or a Promoter who decides to develop a piece of land will prepare a layout comprising of multiple residential plots with proper road access to every plot, space for recreation (park), space for public purpose (shops, schools, health centers) etc and approach the approving authorities like DTCP or CMDA. If the layout satisfies the guidelines laid by the Government then it will be granted approval & an approval number will be given to the said layout with seal & signature of the approving authority. |

| Unapproved Layout | Layouts prepared by Individuals or Promoters on their own & will not have any approval from government authorities. Most of the unapproved Layouts donâ€TMt satisfy the guidelines laid by the government & hence the end buyers / users will have to pay OSR FEE to the government if they go for building construction if the layout comes under regularization scheme. |

| Building Plan & Approval | An Individual or a Promot Contenter who decides to construct an Individual House or an Apartment or Commercial Complex etc has to prepare a Building Plan with the help of an architect and should approach either the local body (Panchayat, Municipality or Corporation) or CMDA for approval. If the plan satisfies the guidelines laid by the Government then the plan will be certified by the approving authority with seal and signature. |

Records maintained & issued by the Revenue / Registration Department of Tamil Nadu Government.

| Records maintained & issued by the Revenue / Registration Department of Tamil Nadu Government | |

|---|---|

| Patta | One of the most important documents required while making property transaction is Patta. A Patta is a revenue record (legal document) issued by the Government in the name of the actual owner of a particular plot or land. The Importance of Patta – Patta is the only legal instrument which establishes lawful ownership and possession of a property, and is a powerful tool that can be used in case of property disputes. In case of government acquisition of land too, the patta holder only is paid compensation, as s/he has the first right to title over that property. Patta can be obtained from the Taluk Office through Village Administration Officer (VAO). |

| Chitta | Though Patta is important but it provides limited amount of information about the type of property. Chitta and Adangal provide a more complete documentation for the type of the property which might be especially important for the VAO to assess tax for the land. Chitta document will be with VAO, and also a copy in the Taluk office, and will contain details such as the survey number with subdivision, village, taluk, district , the current owner, patta number etc. |

| Adangal | Adangal contains details about each piece of land in a particular village and contain information such as Survey number, Wise holdings, Extent of field, Duration of tenancy, Details of first crop, Details of second crop, Month and date of harvest, Approximate yield of crops, State on ground particulars. |

| A Register | An ‘A’ register is a record of the land held at the VAO’s (Village Administrative Officer) office. The ‘A’ register is a government record that contains all the survey numbers and its subdivisions with the classification of the land and its extent in acres or hectares, and details of the property such as tax assessment, owner’s name etc. When you buy land, you want to confirm if the details in the sale deed are authentic. So apart from checking the parent / current documents etc. it’s important that you verify ownership and land details in the ‘A’ register extract which can be got from the VAO. |

| FMB | FMB sketch (Field Measurement Boundary / Book) is a map of a land with measurements prepared by the Government Surveyor which is used to verify land measurement details such as survey area, plot area, boundary details etc. |

| Encumbrance Certificate (EC) | Encumbrance Certificate issued by the Registrar Office will list all transactions involved in a land till date which includes loans, collateral or legal issues. |

| Legal Heir Certificates | If the head or a member of the family expires, the next direct legal heir of the deceased such as the wife or husband or son or daughter or mother have to apply for Death Certificate & Legal Heir Certificate for the purpose of transferring Electricity connection, House Tax, Bank Account, etc and for selling or buying assets. |

Few major criteria to be considered before property purchase

| Criteria | General Preference | Expectation |

|---|---|---|

| Locality / Area | Nice Locality with sufficient ground water. (Avoid – Slum / Burial / Burning Ground / Low Lying area / Canal / Lake, etc) | No Compromise |

| Approval | CMDA / DTCP approved is always preferred. (Purchase of Patta land is subject to building plan approval from government under Regularisation scheme in CMDA Limit) No Loan feasibility for Patta Land unless it has building plan approval. | No Compromise |

| Acquisition | Area should be free from acquisitions like ASI, PWD, Highways, Housing Board, etc | No Compromise |

| Title / Document / Papers | Clear title without any legal issues. Up to date Revenue Records. All necessary documents without any loss / damage. | No Compromise |

| Accessibility / Proximity | Near to Bus & Railway Station / Shops / Schools / Bank, etc | No Compromise |

| Plot Extent / Area | To Suit every individual’s requirement (1000 Sqft to 2400 Sqft). Plot availability below one ground (2000 / 1800 / 1500 / 1200 / 1000) is limited. | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

| Plot Dimension / Frontage | Square / Rectangle (Minimum 25 Feet Frontage) No cross or irregular shape / Corner is always preferred / To meet Vasthu | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

| Plot Direction / Facing | East / North / South / West | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

| Road Width / Type | 60 / 50 / 40 / 30 / 24 /20 / Cement Road / Tar Road / Mud Road | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

| Loan Flexibility | Seller to Cooperate for settlement through Loan. Higher Registration Value for maximum Loan settlement – Capital Gain Impact | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

| Guideline / Registration value | If purchased through Loan Seller to cooperate for Higher Registration Value enabling the Buyer to get Maximum Loan | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

| Price / Budget | Affordable Price to suit your budget | Compromise is possible here basis our requirement Getting tick in the box for 12 / 12 is least possible. |

Meet the Seller, go through the original documents, verify & confirm the dimensions mentioned in the document / layout synchronise with the physical measurement, negotiate the price & freeze the settlement time..

| Settlement of Funds through | Own Fund | Loan |

|---|---|---|

| Any one ID Proof – PAN Card / Passport / Driving License / Aadhar Card / Voter ID | √ | √ |

| Any one Address Proof – Ration Card / Passport / Driving License / Aadhar Card / Voter ID Card | √ | √ |

| Property Documents – Parent Documents, Current Documents, Layout Map, Patta, Chitta, Adangal, A-Register, FMB & any other records related to that property. | √ | √ |

| Latest Encumbrance Certificate | √ | √ |

| Salary Slip, Rental Income, or any other proof of income, last 6 months Bank Statement & any other documents required by the Bank to sanction loan. | √ | √ |

Every individual currently have dreams to have their own home. To make affordable best option is home loan. Again there are sub-categories of home loans which are as below.

Home Loan is a loan against buying property. Every individual currently have dreams to have their own home. To make affordable best option is home loan. Again there are sub-categories of home loans which are as below.

Loan against Insurance Policies – You can use your insurance investment as either collateral or take loan from insurer itself if that policy is eligible for loan. Usually loans will be available after 3 years of policy period. You will get loan easily on your policy from insurer. But other method to take loan is to pledge your policy document with banks and take loan on that.

Loan against Bank FDs – This is one form of loan where your collateral is your bank FD itself. But interest rate will 1-2% higher than your FD rate. But still this form of loan is also fastest and best way.

Loan from PPF or EPF – You can avail loan from PPF / EPF when one satisfies certain conditions. But you can avail loan from EPF only for special purposes like purchase of plot, medical treatment, education or marriage of children, construction or purchase of house, repayment of home loan, and renovation of home or pre-retirement. But all are not eligible to take loans. There are certain conditions like minimum years of completion, age or proof you need to produce.

Loan against Shares or Mutual Funds – Few lenders offer loan against your investment value of shares or mutual funds.